Pers pension calculator

The CalPERS Pension Buck. I read that this calculator doesnt include COLA banking.

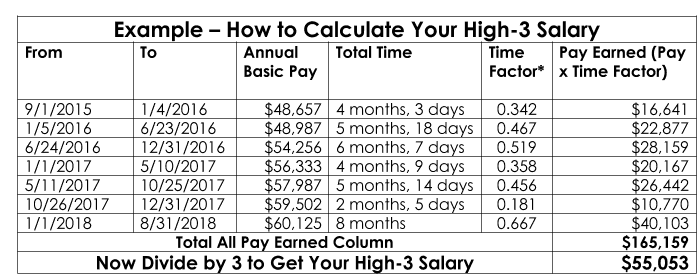

How To Calculate Your High 3 Salary Plan Your Federal Retirement

Plan 3 is two separate accounts.

. When using Safari Chrome or Firefox PERS recommends downloading each desired form for the purpose of filling in andor printing. To Have Forms Mailed to You To have PERS mail you a form fill out the contact information below and then select the box to the left of your desired form. Post Retirement Pension Adjustments PRPAs The automatic Post Retirement Pension Adjustment PRPA is payable to eligible Public Employees Retirement System PERS retirees when the cost of living increases.

When you meet plan requirements and retire you are guaranteed a monthly benefit for the rest of your life from the employer-funded pension. Public Employees Retirement System PERS is a defined benefit plan where retirement benefit is based on a formula and guaranteed by the state. You may choose to model this adjustment by entering a number in the range 0-3.

Plan 1 members of PERS and TRS can choose to reduce your initial benefit and receive an annual Cost-of-Living Adjustment called an optional COLA. If you need to make corrections follow the instructions on the back of your statement. Rowe Price Associates retirement-income calculator at troweprice.

Medical plans benefits. September 6 2022. However if you are vested in your prior inactive PERS account you may be able to transfer your old account to your new one.

Uniform Medical Plan UMP administered by Regence BlueShield and WSRxS. 2008 and Chapter 2 PL. PERS Membership Tier 3 Eligible for enrollment on or after November 2 2008 and on or before May 21 2010.

Most PERS DB plan employees contribute 675 of their gross PERS eligible salary to PERS. Your pension money will be direct deposited into your bank account on the last business day of the month. PERS Membership Tier 2 Eligible for enrollment on or after July 1 2007 and before November 2 2008.

Medical plans available by county. The AARP retirement calculator and the CalcXML offering do allow you to enter a monthly pension and an annual adjustment for it. If youve received a Retirement Benefit Estimate use the numbers and information it provided.

While all systems are primarily defined benefit plans many plans introduced a defined contribution portion for members hired more recently in order to supplement what the employers and pension fund will have to. 2007 Chapter 89 PL. An employer-funded pension and an investment account you fund with your contributions.

Public Employees Retirement System PERS Plan 3. The Washington Retirement System managed by the Department of Retirement Systems DRS is a somewhat sprawling collection of retirement plans. We will produce a sample estimate with pension payment options available to PERS and TPAF members.

As of June 2021 CalPERS income over the last 20 years demonstrates that every dollar spent on public employee pensions comes from the following sources. PERS Membership Tier 5 Eligible for enrollment on or after June 28 2011. This webinar is approximately 30 minutes in duration including a.

On July 1 of every year following your first full year of retirement both Plan 2 and Plan 3 provide an annual cost of living adjustment to your defined benefit pension based on the Consumer Price Index CPI for Seattle to a maximum of 3 percent per year. PERS and TPAF members can choose from a number of different Pension Options that allow you to leave a life-time survivor benefit to a beneficiary after your death. PERS Plan 1 is a lifetime retirement pension plan available to public employees in Washington.

However if you are vested in your prior inactive PERS account you may be able to transfer your old account to your new one. PERS Membership Tier 4 Eligible for enrollment after May 21 2010 and before June 28 2011. Kaiser Permanente WA plans.

You choose your Plan 3 contribution rate and the rate is fixed- an amount between 5 and 15 percent. Membership Tiers and Eligibility The passage of Chapters 92 and 103 PL. This type of transfer is called a Tier-to-Tier Transfer.

This is not a. Benefits coverage by plan. 42 Former Membership under the PERS TPAF or PFRS is considered equivalent to SPRS service upon payment of any required rate differential be-tween the former pension system and the SPRS for SPRS members who retire effective November 1 2019 or thereafter.

However here are four additional less personalized retirement calculator with pension options. Having two separate accounts means you can withdraw from your pension or investment account without affecting the other account. If you do not have an online account DRS has another withholding calculator available to you.

2010 changed the enrollment and retirement criteria for PERS members enrolled. Some calculators like the CNN Money calculator group pensions with Social Security and other income. The IRS revised the W-4P in January 2022 but PERS cannot currently accept the 2022 revised form.

JRS members also have these additional options. View Exploring Pension Options in our Video Library. You and your employer contribute a percentage of income to fund the plan.

Visit the CalPERS Facebook page. This webinar is designed to show PERS and TPAF members how to do a retirement estimate using the Member Benefits Online System MBOS and the website Long-Range Calculator. If you are a peace officer or fire fighter then you contribute 75 of your gross salary.

HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and. The PFRS SPRS and JRS allow for a continued pension benefit to a survivor. The agency is updating its systems to begin to accept the new IRS form this fall.

His fat sheet is a summary and not intended to rovide all information Retiement PERS an TPAF Pension Options lthouh every attemt at auray is made it annot be uaranteed Option B 75 Percent to. An application will be submitted to enroll you in a new PERS account under the membership tier in effect at the time you return to PERS employment. Your employer contributes to your pension and you contribute to the investment account.

PERS Plan 3 has two parts. When you receive your statement check that all your personal information is correct. If you are a noncertificated school district employee you work less than 12 months a year and youve selected the alternate service option you contribute 96.

Behavioral health services by plan. What information do I need to use the optional COLA Calculator. PENSION PAYMENT OPTIONS When planning for retirement you must be familiar.

Calculators estimate the Maximum Option for retirement available to members of the Public Employees Retirement System PERS. If you indicate the birthdate of a beneficiary the calculator will also estimate survivor options for that beneficiary. Ing the online retirement estimate calculator on the NJDPB website.

As of June 30 2021. An application will be submitted to enroll you in a new PERS account under the membership tier in effect at the time you return to PERS employment. Kaiser Permanente NW plans.

You might want to speak with your tax advisor or the IRS if you have questions about your tax withholding. What is COLA banking. The 2021 statement will reflect your PERS benefits and information through December 31 2021.

In the meantime if you are about to retire from PERS use the PERS 2021 W-4P form for your membership type Tier OneTier Two or OPSRP. Out-of-State Service PERS TPAF and PFRS members are eligible to pur -. You can also test your retirement-spending strategy by using T.

This type of transfer is called a Tier-to-Tier Transfer. PERS mailed 2021 member annual statements to all nonretired members in May 2022. Nearing retirementThere is an IRS withholding calculator available through your online account.

![]()

Opers Financial Wellness Retirement Gap Calculator

Calpers Quick Tip Retirement Estimate Calculator Youtube

Your Retirement Estimate And Payment Options Youtube

Estimate Your Benefits Arizona State Retirement System

Fers Calculator Retirement Benefits Instituteretirement Benefits Institute

Fers Retirement Calculator 6 Simple Steps To Estimate Your Federal Pension Retirement Calculator Federal Retirement Retirement

Retirement Benefits Calculator Dcrb

Estimate Your Benefits Arizona State Retirement System

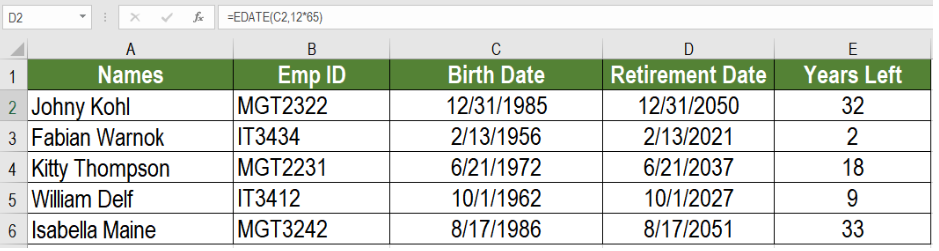

Excel Formula Calculate Retirement Date Excelchat

Retirement Pension Lump Sum Or Monthly Annuity Payment Your Money Your Wealth Podcast 354 Youtube

Calculators Ipers

Your Retirement Calculation Youtube

Retirement Separation Econsys

Benefit Calculator Sacramento County Employees Retirement System

How Much Will I Get

Drs Mid Career

Opers Online Account